Payment and financial services: how to choose your API

Published: August 9, 2018

Mobile finance tech brings merchants and customers closer than ever before. At Orange, we’ve developed a range of

mobile payment APIs to offer secure and seamless transactions to enterprises big and small. Check out our solutions

below to find out which ones are right for you, depending on where you are located and what you are selling.

Find out more about Orange Payment APIs with our use cases, or access our APIs directly below.

What you can do with our APIs & tools

Invoice billing for digital services

Charge users for the sale of your digital services directly on their pre- or post-paid Orange mobile invoice.

To expand its market to non-bank card buyers and to improve its conversion rate, the Pay with Orange Bill API allows a digital application or Internet site to charge on the Orange invoice. Payment is simple, one-click and accessible from any type of equipment (mobile, tablet, PC, etc.).

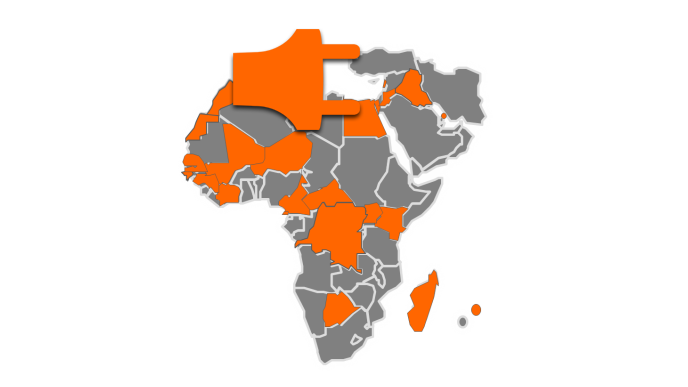

This API applies to mobile or Internet based services in Europe and MEA. To see the list of available countries, click here.

Electronic account management

Simple e-money account creation & management.

APIs can also accompany regulatory developments. That is the case, for example, in banking, where European regulations now allow non-bank players to provide services that were previously reserved for banks only. These new players can then offer access to those services via APIs. Orange is present for this too.

The API eMoney Wallet Manager provides you with the functions of transferring money (payment, cashing) between your users through its management of electronic money accounts. It thereby frees you from having the necessary financial licenses, in particular those of Electronics Currency Establishment (EME).

Through API eMoney Wallet Manager, it is possible to set up services such as Marketplaces, crowdfunding or even collaborative economy.

This API applies to EU mobile or Internet based services in Europe. To know more, click here.

Mobile money payment

Pay for all kinds of services and products in the Middle East & Africa with Orange Money.

In many African countries, Orange Money has emerged as a mobile wallet service for simple, convenient and efficient payments. For example, websites or digital applications that want to be present in the African market and benefit from its dynamism could offer their users the possibility of paying for their purchases with their Orange Money account. Which is what the Orange Money Web Payment API offers.

This API applies to mobile or Internet based services in MEA territories where Orange Money service is available. To see the list of available countries, click here.

Similarly, the revised Directive on Payment Services (DSP2) allows for the opening of the market to new players by, in particular, providing access to bank account information through a secure communication channel. An aggregator, a new player in this market, could thus access users bank accounts through an API (with their agreement of course). The flexibility of its API exhibition platform allowed Orange to drive the Proof Of Concept (POC) of this new scope.

Our payment and financial services APIs

Pay With Orange Bill

Monetize your digital service by enabling Orange subscribers to make direct purchases through their prepaid balance or postpaid invoice.

Orange Money Web Payment

Orange Money is among the most trusted payment solutions in the Middle East & Africa. Process Web payments with our API.

emoney wallet manager

An all-in-one offer to help you operate electronic money accounts, and manage payments & cashing between users.